Total Property -

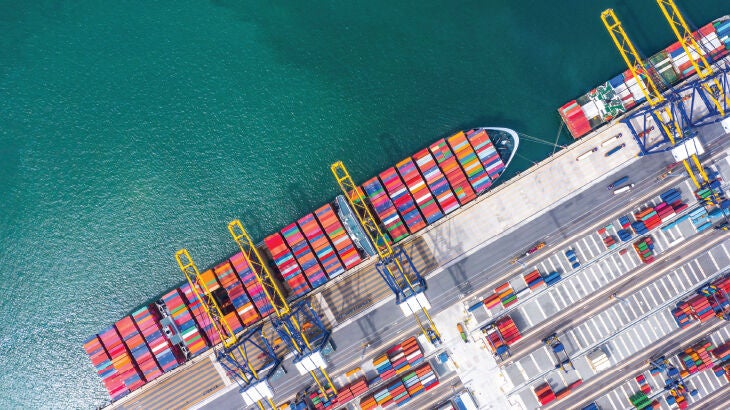

High occupier demand and a secure growth pipeline make freight hubs and inland ports a sound investment bet.

Developments in and around inland freight hubs are in hot demand as both investors and occupiers place high value on warehousing and industrial sites that are secure and easily accessible via key transport links.

In recent years New Zealand’s two largest sea ports, Ports of Auckland and Port of Tauranga, have invested in multiple regional sites around the country to expand their offsite storage capacity. Ports of Auckland now has freight hubs at Wiri in South Auckland, Northgate in Waikato, and Longburn near Palmerston North (a joint-venture with Napier Port and Icepack cold storage).

Port of Tauranga has MetroPorts in Auckland and Rolleston, a container hub in Timaru, and the Ruakura Superhub near Hamilton, a joint venture with Tainui Group Holdings.

Bayleys industrial and logistics experts point to these sites, and land adjacent to them, as offering excellent fundamentals such as robust infrastructure, high demand from occupiers and growing need from the country’s biggest ports.

Data from the government’s Freight Information Gathering System shows Port of Tauranga, the country’s largest port, handled around 700,000 twenty-foot equivalent units (TEUs) of container volume in 2019. In its results for the year ended June 2022, the company reported container volumes had increased to 1,241,061 TEUs. 2019 figures for the Ports of Auckland show it moving more than 400,000 TEUs, with that figure reaching 811,565 by the end of FY22.

Bayleys insights research analyst Ankur Dakwale says with increasing volumes the two largest ports have been investing widely in inland hubs to help ensure freight and logistics companies are more easily able to access their services.

“Ownership of industrial properties near the ports is generally tight and sea ports are often located alongside urban areas, so have limited opportunity to expand,” Dakwale says.

“In some cases, the opportunity for third parties to purchase freehold properties is also limited because the port companies own some of the properties around the port, or leasehold structures have been put in place so that only leasehold interests are readily available.”

Bayleys head of insights, data and consulting Chris Farhi adds that properties near freight hubs offer excellent prospects and robust fundamentals for investors.

Typically offering well-established transportation networks across both road and rails, freight hubs are extremely appealing to occupiers, Farhi says.

“They’re in desirable locations for most occupiers because they have well-established infrastructure which can simplify logistics and lower transport costs.

“There’s also security for investors because the ports these freight hubs serve represent huge infrastructure and are unlikely to move in the short term,” he says.

Bayleys national director industrial and logistics Scott Campbell says demand for these ‘port-adjacent’ sites is strong and growing from both occupiers and investors around the country.

“There’s always been interest from investors in this category of development and it has always been of higher value because it offers speed to market and lower freight costs.”

South Auckland

Southern areas of the Auckland region, particularly Wiri and Drury have the added advantage of being adjacent to Auckland International Airport as well as Ports of Auckland and inland freight hubs, Campbell says.

Key industrial and logistics developments in the region include the Logos Wiri Logistics Estate, and Drury South Crossing, a master-planned industrial estate. Both have experienced much faster uptake from occupiers than predicted, particularly from food sector businesses, Campbell says.

“The Logos development in Wiri had a gestation of about 10 years and they have filled it in five. It’s a similar story with Drury South Crossing which had a gestation of 15 to 20 years and the uptake there has been about 40% faster than anyone anticipated,” he says.

The next cab off the rank in the area will be Basalt Business Park, which should attract the same high levels of interest, located about three kilometres away from the Ports of Auckland inland port and five kilometres from the airport.

Campbell adds that the other investment category likely to benefit from the growth of freight hubs and inland ports is ‘last mile of delivery’ logistics developments, housing distribution centres and couriers. “They aren’t necessarily close to the hubs and ports but they are where most of the goods end up, and there is a lot of growing interest in those types of developments, particularly with the growth of e-commerce.”

Waikato

Bayleys Waikato commercial director David Cashmore says that the region is uniquely located for ease of access to the ports in Auckland and Tauranga via both road and rail networks, making it a sought-after location for freight, storage and logistics operators.

“The logistics of having a Waikato base just make sense. It’s why both Port of Tauranga together with Tainui Group Holdings (TGH), and Ports of Auckland have set up inland ports here,” Cashmore says. “The access to transport networks here make it a great place to offload from trains and distribute around the country without the complexity of having only one road in and out.”

Land near the inland ports at Ruakura Superhub and Northgate is in increasingly high demand, Cashmore says.

“The accessibility, with access to major expressways, is key, but there is also a snowball effect. The more businesses that locate in these industrial freight hubs, the more appealing they become to other businesses.

TGH has leased approximately 19.5ha of logistics and industrial-zoned land via a combination of design-build and lease projects, at the Ruakura Superhub which includes the joint venture Ruakura development with Port of Tauranga.

Other Ruakura Superhub projects include the 13,000sqm Big Chill cold store distribution facility design build and lease, and a 40,000 sqm Kmart distribution centre, a 5,000sqm regional hub for PBT and a 4.5ha ground lease where Maersk are developing a 16,000 sqm cold store facility. TGH has also entered into a 1.6ha ground lease for a service centre near the Superhub, with Waitomo Group and its partners McDonalds and KFC.

Tainui Group Holdings general manager development Peter Tuck says the Ruakura Superhub is particularly sought-after because of the commercial benefits it offers compared to other North Island locations.

As well as its prime location in the ‘golden triangle’ between Auckland, Hamilton and Tauranga, and access to transport routes, the inland port allows companies to future-proof supply chains against unforeseen disruption.

“We have seen an increase in interest from investors, developers and occupiers for the Ruakura Superhub particularly on the back of recent supply chain difficulties, as Ruakura Superhub has the ability to access both the Port of Tauranga and Ports of Auckland via rail which provides strategic optionality to businesses, and supply chain resilience,” Tuck says.

“At present about 65% of NZ’s freight is transported within the Golden Triangle and the volume of freight is forecast to double over the next 20 years. Ruakura Superhub is located at the nexus of this freight movement. In short, the location will continue to be in demand irrespective of where we are in the property cycle.”

Another advantage of creating freight hubs and inland ports is the ability to aggregate cargo from co-located importers and exporters, reducing freight costs, Tuck says.

“At 490ha, Ruakura Superhub offers sites which can accommodate the emerging class of super distribution centres demanded by global supply chains.”

Tuck says Ruakura Superhub also offers broader social opportunities as well having commercial and financial appeal for investors. Those include de-carbonisation of the supply chain by shifting more freight from road to rail, and the ability of TGH to return distributions to its Waikato Tainui iwi owners to be invested in local social, cultural, environmental and economic programmes.

Environmental sustainability has played a key role in the Superhub development, with enhanced stormwater design using open swales, and a 10ha wetland with habitat creation for native eels and lizards, Tuck says. The site also includes the creation of greenspace, an embedded solar network, cycleways, walkways, and planting of more than a million plants for stage one development.